Palantir Stock Is Running Higher on AI FOMO

Artificial intelligence and data analytics are two of the most revolutionary technologies of our time, and at the heart of this revolution is Palantir Technologies (NYSE:PLTR). This software giant has carved out a significant slice of the market with its innovative data integration and AI-driven platforms, but is PLTR stock a wise investment choice after an incredible year-to-date surge?

Palantir specializes in creating software that enables organizations to integrate and analyze massive amounts of data. Its two primary platforms, Gotham and Foundry, serve government and commercial clients, respectively. Palantir’s third platform, Apollo, ensures seamless delivery of its software. The company’s name is inspired by the “seeing stones” from J.R.R. Tolkien’s Lord of the Rings series, reflecting its ability to offer deep insights from complex data sets.

How Palantir Works

The Gotham platform, initially developed for defense and intelligence operations, has broadened its client base to include various government functions and some commercial clients. This platform integrates data and information from a wide variety of sources and identifies patterns hidden deep within. The insights then can guide planning and mission execution.

The Foundry platform primarily serves Palantir’s commercial clients. It allows organizations to gather and scrutinize vast data sets, enabling them to make more informed operational decisions. Foundry’s applications range from anti-money laundering to supply chain management across various industries.

Apollo is Palantir’s most recent platform. It aims to ensure continuous delivery of its Foundry and Gotham software to users operating in the cloud, on-premise, or using classified networks. Apollo provides necessary updates and upgrades automatically without any user downtime.

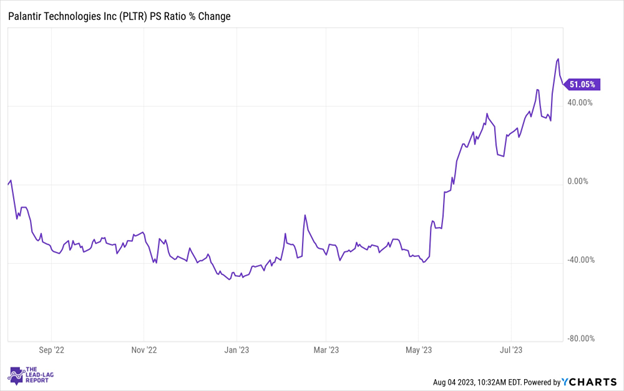

All of this is incredibly impressive, and clearly a high growth area. But PLTR’s stock price isn’t driven by AI, but ultimately, by people who confuse narrative with FOMO.

The Bottom Line on PLTR Stock

Palantir has showcased impressive financial growth over the past few years. In 2020, it recorded 47% revenue growth, followed by 41% in 2021. However, the company’s growth cooled off in 2022 with a 24% increase in revenue, falling short of its earlier claims of achieving at least 30% growth through 2025. Despite this slowdown, Palantir has managed to stay in the black for the last two quarters and expects to maintain profitability throughout 2023.

The big data and business analytics market is fiercely competitive, with established IT vendors and new entrants vying for market share. Palantir faces stiff competition from other advanced data analytics companies like Alteryx (NYSE:AYX), Databricks, International Business Machines (NYSE:IBM), and C3.ai (NYSE:AI). However, Palantir’s reputation as a premium vendor, its environment-agnostic software deployment capabilities, and its stringent privacy and security controls seem to give it a competitive edge in the market.

The problem I have with Palantir is valuation against AI mania which has run wild this year. With an enterprise value of $32 billion, it trades at 19 times its annual sales, which is steep. In addition, if markets do undergo a correction, I find it hard to believe that Palantir’s stock wouldn’t get significantly hit.

Bottom line? Yes, momentum appears to be alive and well, but I think PLTR stock is stretched and vulnerable to a breakdown. Should that occur, it might make sense to reload at lower prices. It’s an attractive story overall and one that clearly continues to capture investor attention. But there’s a price for everything that’s fair, and I’m not sure it’s where the stock currently trades at now.

On the date of publication, Michael Gayed did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.