The 3 Best Quantum Computing Stocks To Buy Now: October 2023

Quantum computing may grow as fast, or potentially even surpass the growth rate of generative AI and other revolutionary technologies. Industry insiders predict a future in which quantum computers mimic human brains. They’ll solve complex problems like optimization, cryptography, machine learning and simulation. Thus, there’s a solid thesis as to why investors should identify the best players in this sector, and invest patiently at opportune moments. This drove us to create this list of the quantum computing stocks to buy.

That said, investing in such technologies is no small feat. It requires advanced knowledge of the market, the industry and the technology itself. But fear not, as there are a few clear leaders in this space worth diving into. Here are three quantum computing stocks on my watch list right now.

Quantum Computing (QUBT)

Quantum Computing (NASDAQ:QUBT) offers quantum computing processing units like the Entropy Quantum Computer and cloud-based software, Qatalyst. The company serves quantum computing firms and government agencies, making it a relatively affordable quantum computing stock worth considering.

In August, QUBT reported its Q2 earnings. The company’s one-year merger with QPhoton was successfully completed as well. Theismerger has doubled the company in terms of personnel, facilities, assets, and business scope. The company now focuses on nanophotonic-based quantum technology, aiming to democratize quantum tech. According to QCi CEO Robert Liscouski, Quantum Computing has made significant progress in developing quantum photonic chips and launching innovative quantum-enabled products and services.

For those bullish on the growth over the overall sector, this is a unique way to play this space.

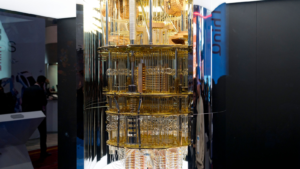

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI), located in Berkeley, California, is a leading quantum computing stock. The company develops quantum integrated circuits and a cloud platform for quantum algorithms. While RGTI stock has nearly doubled this year, it’s also down big on a year-over-year basis, as well as from its 52-week high seen this summer. Thus, this potential dip may be a buying opportunity for aggressive investors.

That’s because Rigetti collaborates with prominent organizations, including NASA, the United States Department of Energy, and the ADIA Lab in Abu Dhabi. Favorable earnings and ongoing trends make Rigetti’s future promising. Long-term investors may reap significant rewards as the company expands its product offerings.

Additionally, Riverlane, a long-term partner of Rigetti, is now using Ankaa-1 to enhance error correction techniques for Rigetti’s latest architecture. Ankaa-2, an upcoming innovative system, will be available to the public in Q4. Rigetti aims to offer practical quantum solutions across various industries to unlock quantum’s full potential and expand its business. This progress in the current quarter has led to a positive response in Rigetti Computing stock.

D-Wave Quantum (QBTS)

D-Wave Quantum (NYSE:QBTS) reported Q2 earnings below expectations, causing a 12% stock drop. However, the company also saw a 146% year-over-year increase in revenue bookings, indicating growing enterprise interest in their quantum annealing technology. With their Leap cloud platform, D-Wave can continue to tap into the evolving quantum computing market.

D-Wave is a promising quantum computing stock, despite recent challenges. They are the first to sell quantum computers with quantum effects in British Columbia. Several notable enterprises in aerospace, defense, and government use their quantum annealing technology.

Rigetti develops quantum ICs and a cloud platform for quantum programming. The stock saw a 138% year-to-date gain but recent declines led to technical sell signals and a “neutral” consensus. Yet, analysts suggest a $3.50 price target, hinting at 101% upside potential for QBTS stock. If you are looking for the quantum computing stocks to buy, this is a great place to start.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.