3 Top-Rated Flying Cars Stocks That Analysts Are Loving Now

What once seemed like fiction, may soon become reality. In the past few years, dozens of companies have emerged with one mission, the creation of the world’s first fully functional flying car. The flying car industry was valued at around $220 million in 2022. But, flying car stocks look ready to take off. Over the next two decades, experts forecast that the industry will surpass more than $1.5 trillion.

Flying cars are more environmentally friendly, while they also reduce travel time and increase productivity. They can revolutionize transportation as we know it. Though there is still much needed for their creation, here are the three best flying car stocks to look out for.

Archer Aviation (ACHR)

Archer Aviation (NYSE:ACHR) is a cutting-edge company specializing in electric vertical takeoff and landing (eVTOL) aircraft. Archer’s flagship product, the Maker, is a two-passenger eVTOL aircraft with speeds up to 150 mph and a range of 100 miles. The company has a significant partnership with United Airlines (NASDAQ:UAL), which has ordered two hundred electric aircraft.

A fundamental analysis of the company’s financials also underscores its promising position. As of the third quarter of 2023, Archer has exhibited a robust financial standing. It is marked by a noteworthy 12.07% increase in total assets, reaching $539.6 million. Notably, the company’s balance sheet reflects a substantial reduction in total liabilities by 14.67%, now standing at $175.10 million. This financial resilience positions Archer favorably for future growth and potential market dominance within the evolving landscape of urban air mobility.

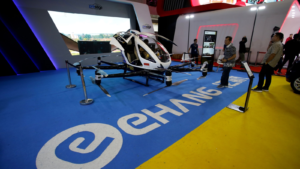

EHang Holdings Limited (EH)

EHang Holdings Limited (NADAQ:EH) is a trailblazing force in the field of urban air mobility. The company specializes in the development and manufacturing of autonomous aerial vehicles (AAVs) for diverse applications, including cinematography, emergency response and survey missions. Notably, EHang gained global recognition for unveiling the world’s first autonomous passenger drone, the EHang 184, in 2016. Recently, EH achieved a significant milestone with the approval of its EH216-S for commercial flights by the Civil Aviation Administration of China. This certification marks a pivotal step towards realizing the vision of flying taxis. And, it positions EHang as a key player in shaping the future of urban air transportation.

The annual income statement data shows that despite an operating loss of -$43.72 million, the company’s total revenue has shown consistent growth. It reached $6.38 million in the most recent period. Gross profit has also seen an uptick, reaching $4.20 million. While operating expenses are notable, including research and development costs, its commitment to innovation underscores the company’s growth potential. With a solid foundation in both technical and fundamental aspects, EH presents a compelling investment case.

Embraer (ERJ)

Eve Urban Air Mobility Solutions, a subsidiary of Embraer (NASDAQ:ERJ), is a prominent player in the flying car industry, focusing on eVTOL aircraft. In collaboration with Uber (NYSE:UBER) Elevate, Eve aims to launch an air taxi service in 2023. Their eVTOL design prioritizes safety, reliability and community-friendliness, featuring a sleek fuselage with large windows for optimal passenger experience. With a commitment to disruptive innovation and urban mobility, Eve is actively contributing to the development of eVTOL technology. Recently, they unveiled a full-sized cabin mockup at the Farnborough International Airshow, signaling a tangible advancement in their efforts to revolutionize urban air transportation.

The company also boasts strong fundamentals, with more than 70% of its peers exhibiting a lower mix of growth, profitability, debt and visibility. Notably, Embraer’s core activity demonstrates significant growth potential, with sales expected to surge by an impressive 49% by 2025. The enterprise value to sales ratio, a key fundamental metric, currently stands at 2.84, indicating that the company is undervalued. Analysts hold a positive opinion on ERJ, recommending an overweight or purchasing stance.

On the date of publication, Tomas Levani did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.